Flash Sale: 50% off Logo Shop. Promotion ends 4.23.2024 at 11:59 PM PT. Prices are as marked.

Exclusions apply. Cannot be combined with any other offer. Only valid at calvinklein.us.

Not valid on gift cards or previous purchases.

Mid-Season Sale: Up to 40% Off Sitewide Promotion ends 4.29.24 at 11:59 PM PT. Prices are as marked.

Exclusions apply. Only valid at calvinklein.us. Not valid on gift cards or previous purchases.

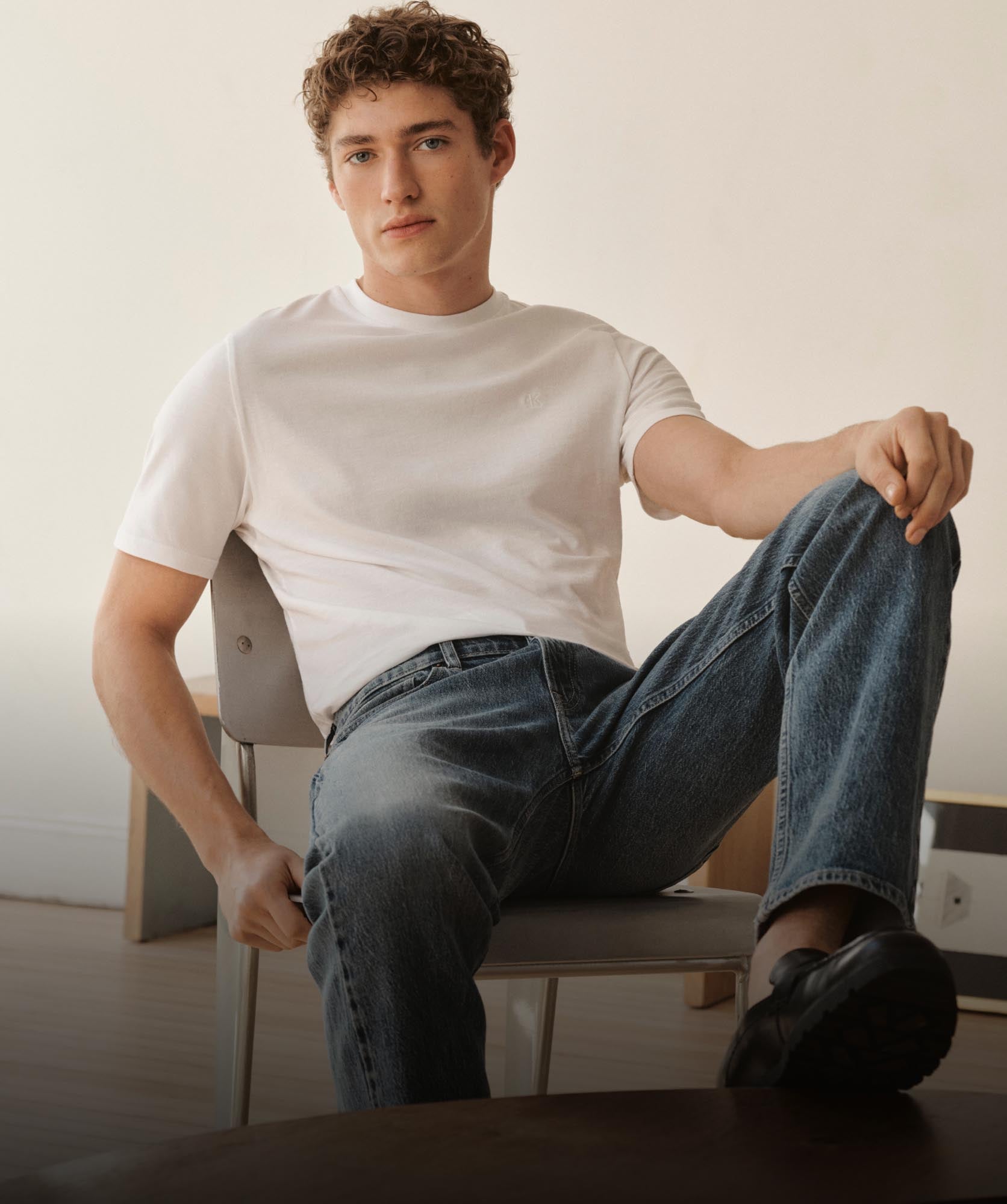

The timeless favorites. Logo tees, signature

denim, refined styles and more.

Ribbed tees, light dresses, casual chinos.

Effortless classics to style all season.

For life at the gym and beyond. Discover

the spring activewear collection.