Spend $100 + get additional 20% Off with code: EXTRA20. Promotions ends 4.22.2024 at 11:59 PM PT.

Discount taken at checkout. Exclusions apply. Only valid at calvinklein.us.

Not valid on gift cards or previous purchases.

Buy one, get one 50% off on all Tees + Polos. Promotion ends 04.21.2024 at 11:59 PM PT.

Discount taken at cart applies to the lowest priced item(s). Exclusions apply.

Cannot be combined with any other offer. Only valid at calvinklein.us.

Not valid on gift cards or previous purchases.

Up to 40% Off Sitewide. Promotion ends 04.21.24 at 11:59 PM PT. Prices are as marked.

Exclusions apply. Only valid at calvinklein.us. Not valid on gift cards or previous purchases.

For life at the gym and beyond. Discover

the spring activewear collection.

Effortless tees, tanks and smooth cotton

polos.

Made to layer or wear alone.

The latest for spring. Explore relaxed shapes

and

polished separates.

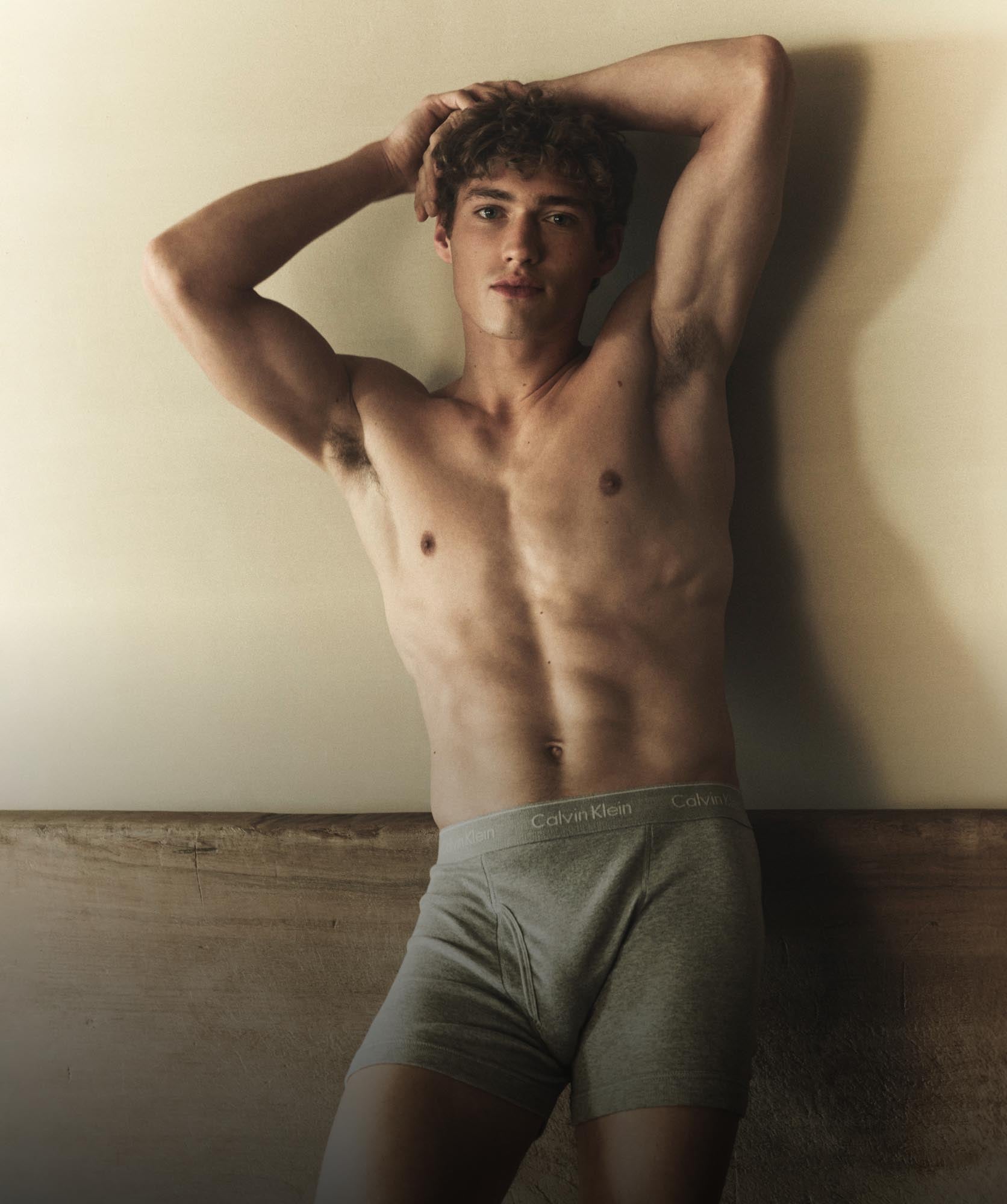

Underwear

Modern Cotton. Invisibles. Cotton Stretch.

Your must-haves for under

everything.

Watch Denim

The new season arrivals. From monochromatic

to

timeless ease to

sculpted and refined fits.